Product and service innovation, along with cost efficiency, remain key areas of improvement for custodian banks, according to Asset Servicing Insights 2025, an annual survey by Asset Benchmark Research ( ABR ).

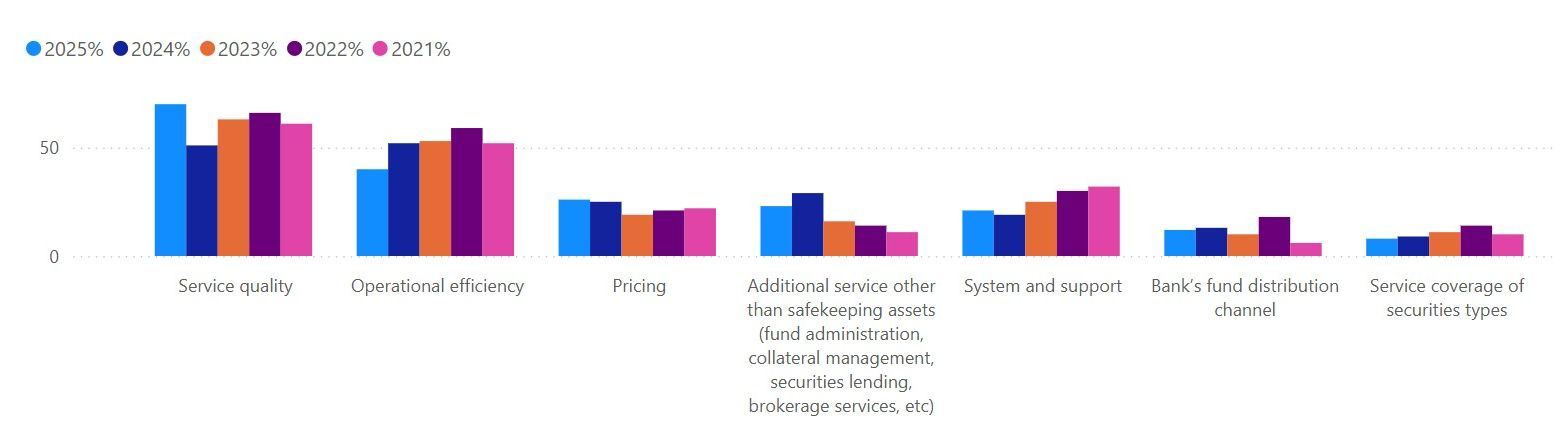

This year’s survey – which gathered responses from nearly 200 participants, primarily asset managers, as well as asset owners, private banks and wealth managers – reveals a significant shift in priorities among respondents, with their focus on service quality having jumped from 51% last year to 70% this year, while that on operational efficiency declined from 52% to 40% over the same period.

Efficiency remains a recurring theme in client feedback with one respondent noting that her “custodian banker consistently provides timely updates regarding custody services and regulations, promptly addressing any queries and escalations, and ensuring efficient resolution.”

Another praised his service provider’s proactive approach: “The banker consistently delivered results and demonstrated exceptional skills by identifying potential gaps in the transition process, taking into consideration different market nuances. His proactive approach and keen eye for detail ensured that we could address issues before they became critical, leading to a smoother and more efficient transition.”

Respondents’ focuses on pricing, additional services, system and support, distribution channel and service coverage have all remained relatively similar to those of previous years. “With the bank’s solid experience,” a respondent, commenting on the performance of his servicing bank, shares, “we are able to streamline the operational efficiency to reduce cost and provide additional service for our client.”

Most important factors when choosing a custodian

Source: ABR

Growing demand for additional services

Clearing and settlement services, considered as an additional service when choosing a custodian bank, have seen a surge in demand, rising from 46% last year to 59% this year.

Fund administration – including reporting and accounting – remains the top additional service, with 71% of respondents prioritizing it ( up slightly from 67% last year ).

There’s also a slight increased in demand for foreign exchange and derivatives transactions.

Top three additional services when choosing a custodian bank

Source: ABR

Some survey respondents comment that their servicing banks are able to help out even in areas for which the bank is normally not responsible, with one pointing out that: “The team [with which she was working] addressed out requests and concerns timely, proactively finding solutions to quickly resolve unexpected issues that arose during transaction settlement.”

Areas for improvement: innovation, costs, and regulation

A majority of asset owners and managers ( 53%, up from 30% last year ) expect custodian banks to enhance product and service innovation.

Fees and costs ( 51% ) and regulatory support ( 39% ) remain key focus areas for improvement.

Additionally, nearly half of respondents ( 49% ) no longer see T+1 settlement as a concern, up from 41% last year, indicating a sign of improving service standards.